excise tax rate nc

Free viewers are required for some of the attached documents. Easily calculate the North Carolina title insurance rates and North Carolina property transfer tax.

Excise Taxes Excise Tax Trends Tax Foundation

The tax rate is one dollar.

. 2016 Piped Natural Gas Tax Technical Bulletin. In North Carolina cigarettes are subject to a state excise tax of 045 per pack of 20. North Carolina Title Insurance Rate Excise Tax Calculator.

North Carolina generally collects whats known as the highway-use tax instead of sales tax on vehicles whenever a title is transferred. Imposition of excise tax. A An excise tax is levied on each instrument by which any interest in real property is conveyed to another person.

2013 nc tax expenditure database. Customarily called excise tax or. Imposition of excise tax.

A An excise tax is levied on each instrument by which any interest in real property is conveyed to another person. In North Carolina wine vendors are responsible for paying a state. 2016 Privilege License Tax Technical Bulletin.

Tax Rates - Guilford County 2022-2023. North Carolinas general sales tax of 475 also applies to the purchase of wine. North Carolina Wine Tax - 100 gallon.

The average local tax was about 215 percent meaning that the average combined sales tax was about 69 percent. GET THE LATEST INFORMATION Most Service Centers are now open to the public for walk-in traffic on a limited schedule. Through June 30 2022 the state excise tax on cigarettes ranges from 0170 per pack in Missouri to 4350 per pack in Connecticut and New York.

Vehicles are also subject to. The tax rate is one dollar. 2016 Alcoholic Beverages Tax Tehcnical Bulletin.

Cigarettes are also subject to North Carolina sales tax of approximately 031 per pack which adds up to. North Carolinas state sales tax was 475 percent in 2015. Excise Tax on Conveyances Article 8E of Chapter 105 of the North Carolina General Statutes General Information Excise Tax is a state tax computed at the rate of 100 on each.

If 100 worth of books is purchased from an online retailer and no sales tax is collected the buyer would become liable to pay North Carolina a total of 100 475 475. The federal tax remains at 1010.

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

How To Calculate Closing Costs On A Nc Home Real Estate

General Sales Taxes And Gross Receipts Taxes Urban Institute

Beer Taxes Nationwide The Hamilton Consulting Group

How High Are Excise Tax Collections Where You Live Tax Foundation

State Sales Tax Rates Sales Tax Institute

Nc Dor B C 775 2019 2022 Fill Out Tax Template Online Us Legal Forms

How Much Does Your State Collect In Excise Taxes Tax Foundation

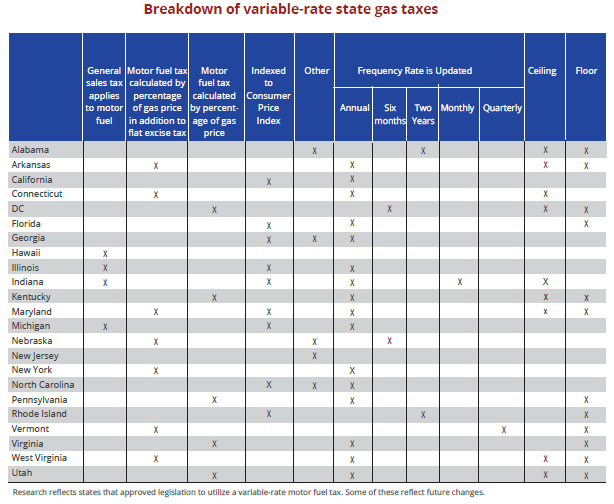

Variable Rate State Motor Fuel Taxes Transportation Investment Advocacy Center

South Carolina Cigarette And Tobacco Taxes For 2022

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

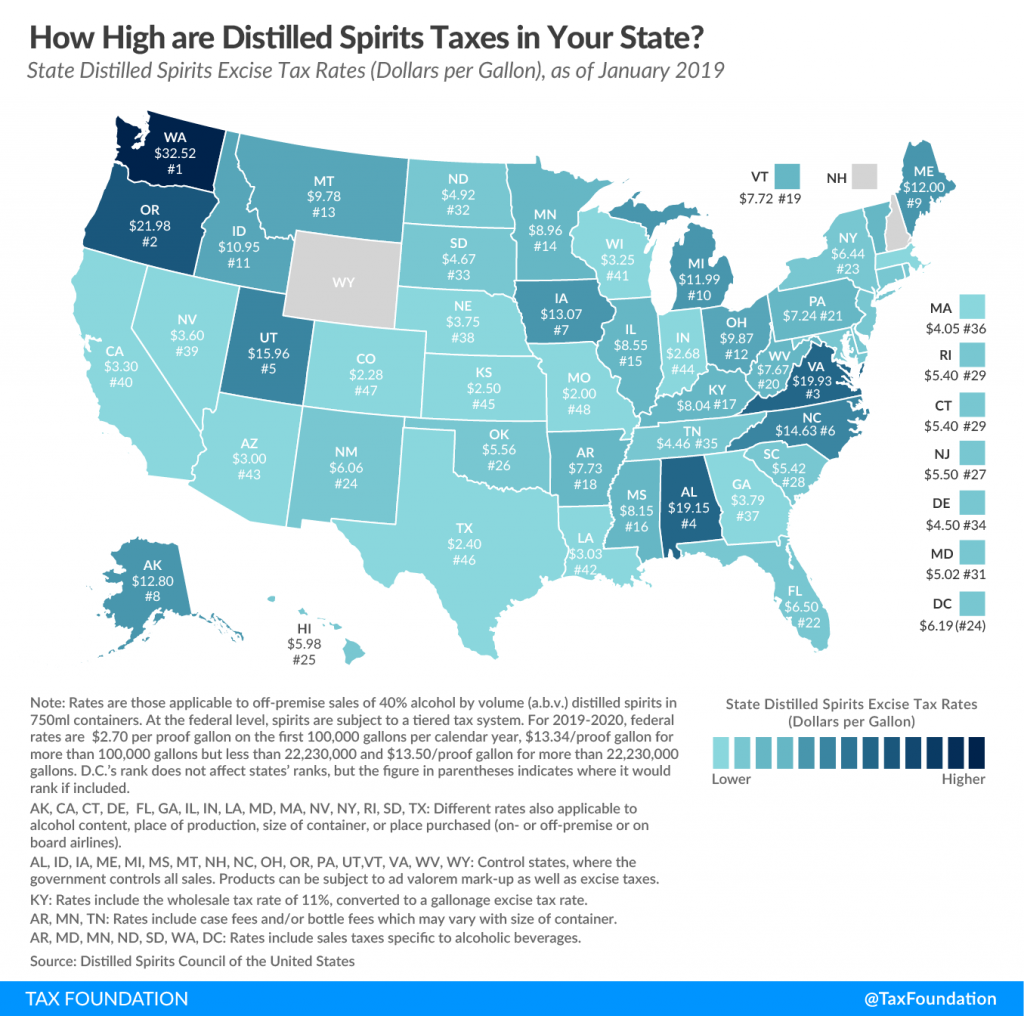

State Alcohol Excise Tax Rates Tax Policy Center

State Excise Taxes For Distilled Spirits Bevology Blog Oh Pinions

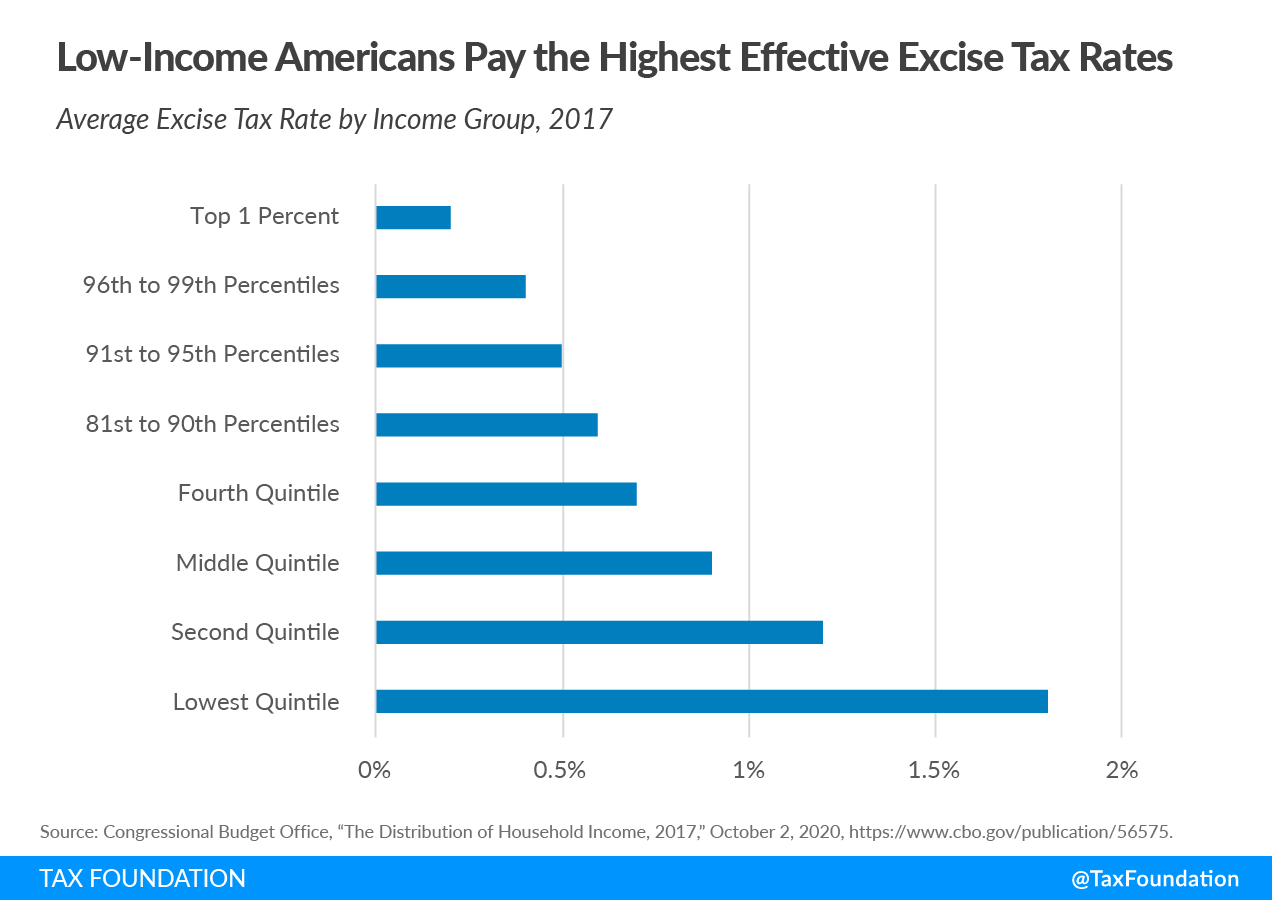

File Effective Federal Excise Tax Rate By Income Group 2007 Jpg Wikipedia

What Is The Gas Tax Rate Per Gallon In Your State Itep

Sales Taxes In The United States Wikipedia