who is exempt from oregon wbf

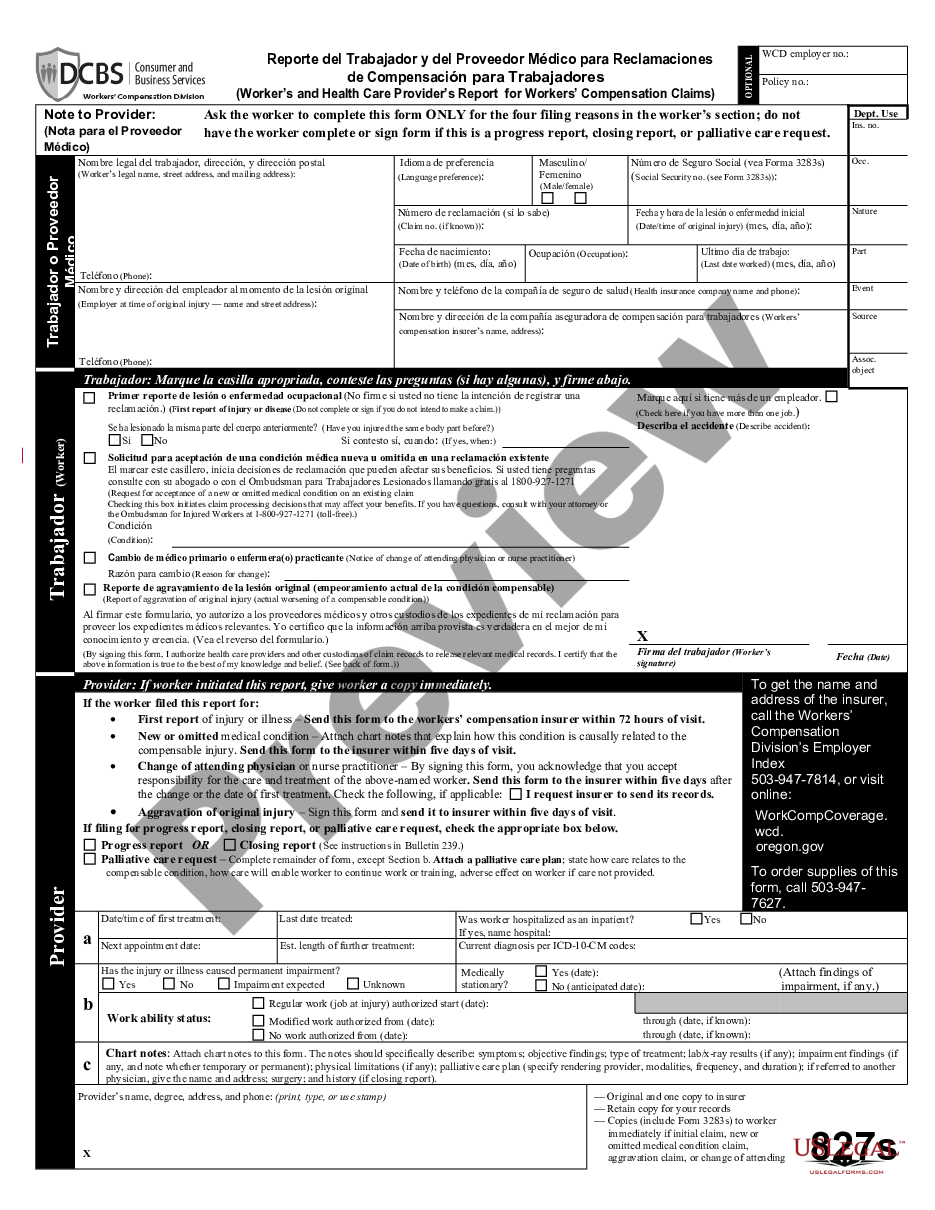

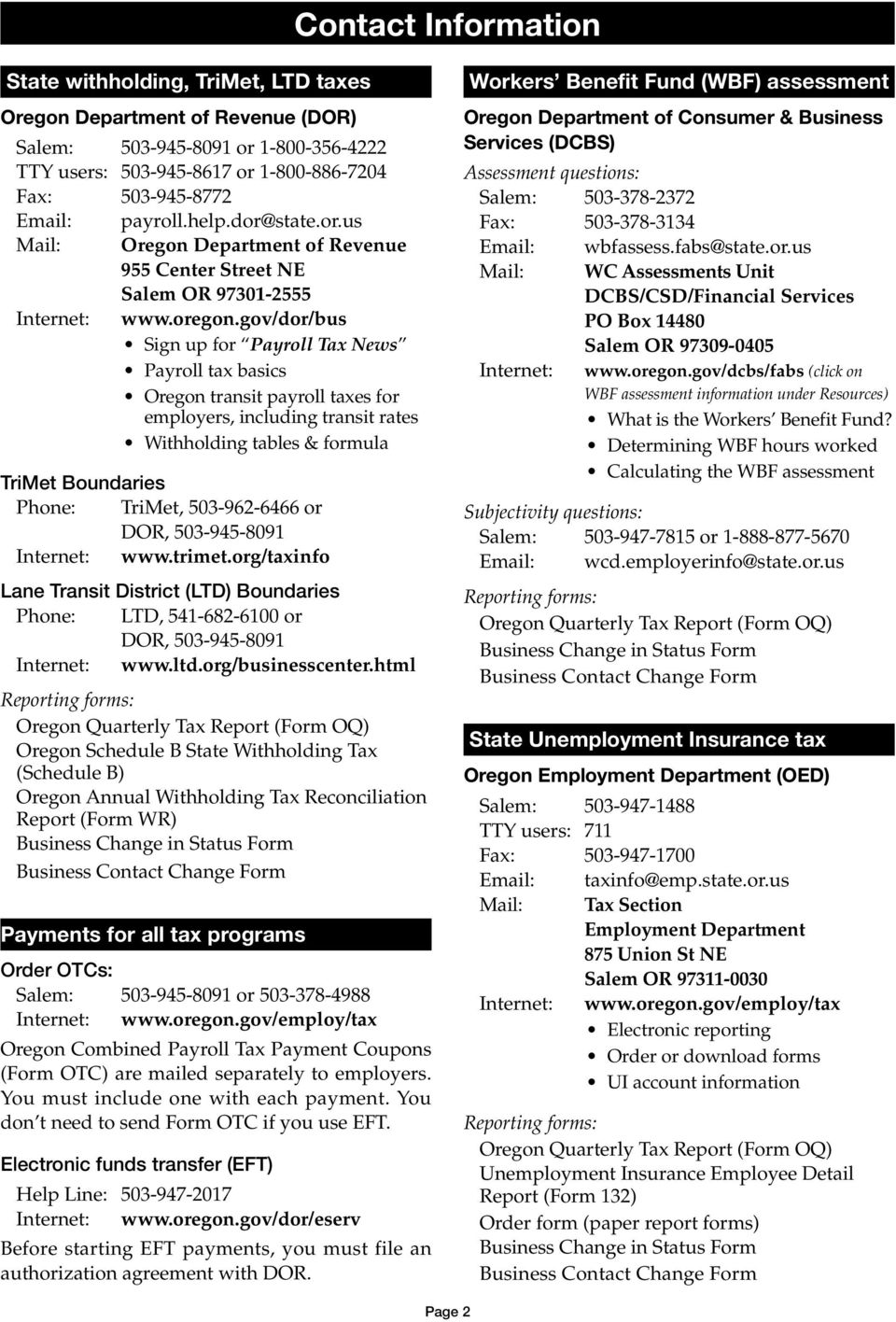

Who is exempt from oregon wbf. Help with workers compensation insurance Workers Compensation Division 888-877-5670 toll-free 503-947-7815 wcdemployerinfodcbsoregongov.

Oregon Workers Compensation Employee Withholding Us Legal Forms

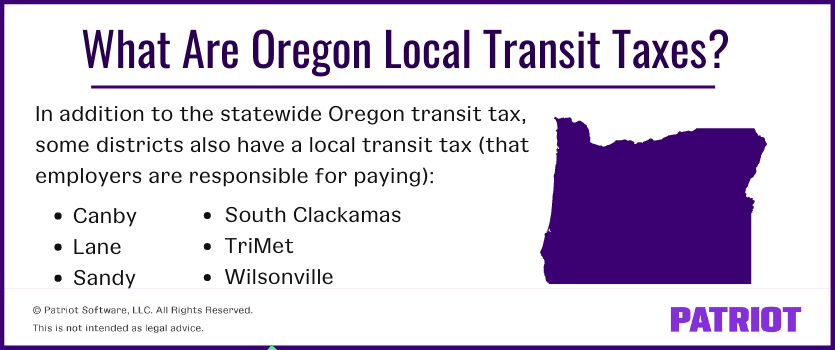

For purposes of the transit district payroll taxes certain payrolls are.

. Oregon employers employee who is injured while working permanently outside Oregon is not subject worker. SAIF 212 Or App 627 159 P3d 379 2007 Sup Ct review denied. If your business is not required to carry workers compensation coverage you are exempt from the WBF Assessment.

The Workers Benefit Fund WBF assessment funds return-to-work programs provides increased benefits over time for workers who are. Tel 541-737-9600 FAX 541-737-8082. The Workers Benefit Fund WBF assessment funds return-to-work programs provides increased benefits over time for workers who are permanently and totally disabled and gives benefits to.

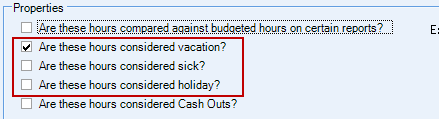

Wages Exempt From Transit Payroll Tax. Select Taxes to display the Federal State and Other tabs. Go to Employees then Employee Center.

For Oregon Benefit Fund choose Exempt How is. Select the Other tab. Payroll Settings Payroll Settings.

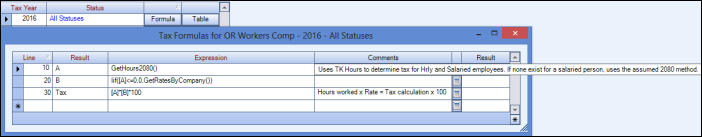

If your business is not required to carry workers compensation coverage you are exempt from the WBF Assessment. The Oregon Workers Benefit Fund WBF assessment is a payroll tax calculated on the number of hours worked by all paid workers owners and officers covered by workers compensation. The Workers Benefit Fund WBF assessment this is a payroll assessment.

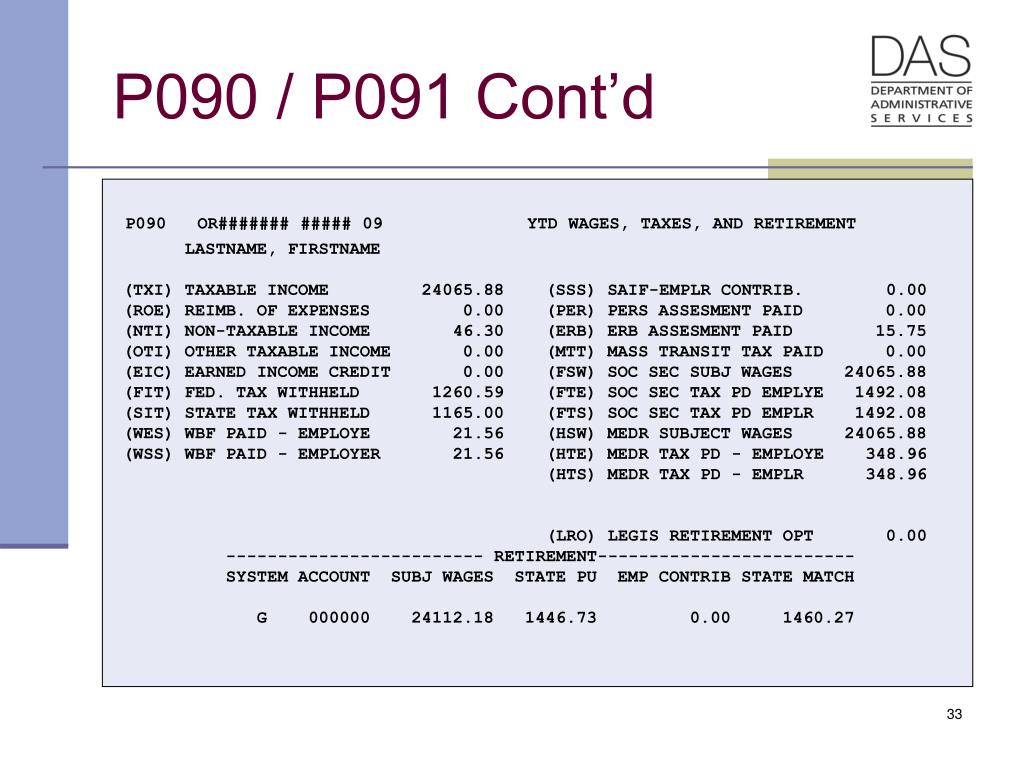

To mark your business as exempt. Office of Institutional Research Oregon State university 500 kerr administration Building Corvallis OR 97331-8572. Temporary total disability benefits.

May 21 2019 358 pm. Double-click the employees name. The DOR is developing a new state.

Rule 150-267-0020Wages Exempt From Transit Payroll Tax. Oregon Workers Benefit Fund. The oregon state state tax calculator is updated to include the latest state tax rates for 20212022 tax year and will be.

What is Oregon WBF assessment. The Oregon Department of Consumer and Business Services has announced that the Workers Benefit Fund WBF assessment is 22 cents per hour worked in 2022 unchanged from 2021.

Oregon Domestic Combined Payroll Tax Report Oregon Department Of Revenue Pdf Free Download

Oregon Domestic Combined Payroll Tax Report Oregon Department Of Revenue Pdf Free Download

Oregon Workers Benefit Fund Payroll Tax

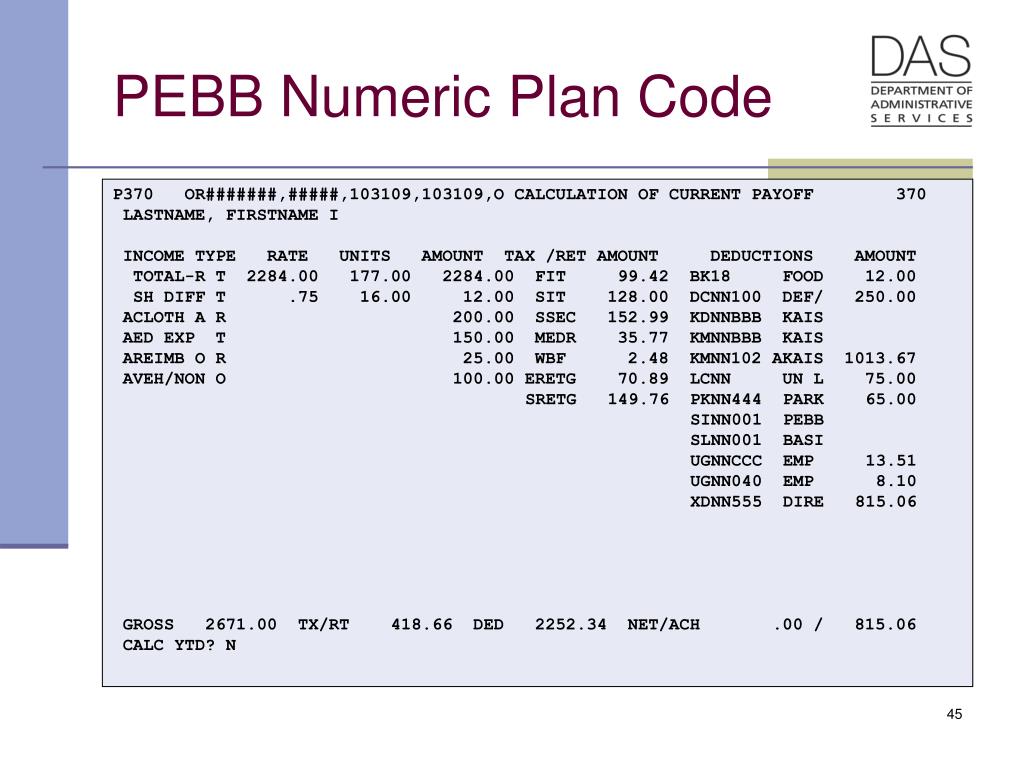

Ppt Ospa Payroll Calculation Powerpoint Presentation Free Download Id 4545812

Form Oq Fill Out Sign Online Dochub

![]()

Oregon Bill Exempts Amateur Athletes From Comp Coverage Business Insurance

This Week In Wild Beauty June 4th 2022 Wild Beauty Foundation

Frequently Used Screens In Ospa Oregon Statewide Payroll Services Ppt Download

Oregon Workers Compensation Employee Withholding Us Legal Forms

Ppt Ospa Payroll Calculation Powerpoint Presentation Free Download Id 4545812

Oregon Domestic Combined Payroll Tax Report Oregon Department Of Revenue Pdf Free Download

Oregon Combined Payroll Tax Report Pdf Free Download

Oregon Paycheck Calculator Adp

Oregon Workers Benefit Fund Payroll Tax

Oregon Workers Benefit Fund Payroll Tax

Oregon Domestic Combined Payroll Tax Report Oregon Department Of Revenue Pdf Free Download

Frequently Used Screens In Ospa Oregon Statewide Payroll Services Ppt Download

The Complete Guide To Oregon Payroll For Businesses 2022

Oregon Domestic Combined Payroll Tax Report Oregon Department Of Revenue Pdf Free Download